The decline in inventories could be attributed to the increase in shipments compared to the arrivals of stocks to warehouses. During October 24-30, aluminium billet shipments in major Chinese consumption areas totalled 47,300 tonnes, up by 16.79 per cent from 40,500 tonnes a week ago.

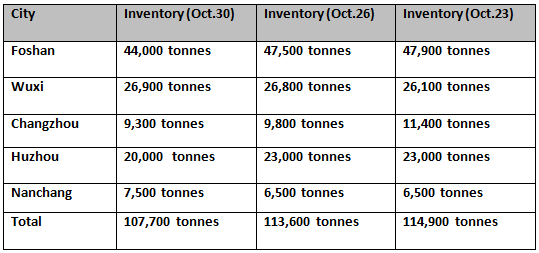

The fall in billet inventories on Monday was primarily contributed by Foshan, in tandem with the highest shipment in that particular province at about 25,400 tonnes, up by 4,100 tonnes W-o-W. To know the current status of aluminium billet inventories across China in more detail, refer to the chart below: